In the rapidly evolving landscape of cryptocurrency, mining remains a cornerstone activity, powering networks like Bitcoin (BTC), Ethereum (ETH), and even newer coins such as Dogecoin (DOG). As the US market continues to expand its appetite for digital assets, the demand for high-efficiency mining machines surges correspondingly. Selecting the right mining rig is no trivial matter—it’s a strategic decision balancing hash rates, energy consumption, upfront cost, and long-term reliability. Whether you’re an individual miner or operating a full-scale mining farm, understanding how to navigate this complex terrain is crucial to maximize returns in an increasingly competitive environment.

Mining machines, often called miners, come with varying architectures optimized for specific algorithms like SHA-256 for Bitcoin or Ethash for Ethereum. Bitcoin mining, for instance, hinges on powerful ASICs (Application-Specific Integrated Circuits) which provide unparalleled energy efficiency and hash power. Meanwhile, Ethereum mining, although transitioning to proof-of-stake, still benefits from GPU-intensive rigs that offer flexibility for multiple altcoins. For Dogecoin enthusiasts, mining often piggybacks on Litecoin’s Scrypt algorithm, creating a hybrid approach that demands specialized hardware. Each coin’s unique cryptographic requirements directly influence mining hardware selection, reinforcing the importance of tailored solutions over generic devices.

Another dimension adding complexity is the hosting of mining machines. Hosting providers offer secure, climate-controlled environments with reliable power and cooling, addressing key operational risks for miners. Particularly in the US, where energy costs and regulations can fluctuate drastically by region, hosted mining farms optimize performance through economies of scale and infrastructure expertise. This approach is highly attractive for investors lacking local access to cheap electricity or preferring to avoid the noise and heat generated by mining rigs at home. Hosting services frequently include remote management tools, real-time monitoring, and repair support, ensuring uptime and enhancing profitability.

Interestingly, the interconnection between mining hardware and cryptocurrency exchanges is often overlooked but plays a pivotal role. Miners must effectively convert mined tokens to fiat or other digital assets, and the choice of exchange impacts liquidity and fees. Certain sophisticated miners orchestrate automated trading strategies that synchronize mining output with exchange dynamics to mitigate market volatility. This trend has accelerated the integration of mining operations with blockchain financial ecosystems, further underscoring the need for miners to appreciate not just the hardware but also the software and financial infrastructures entwined with their craft.

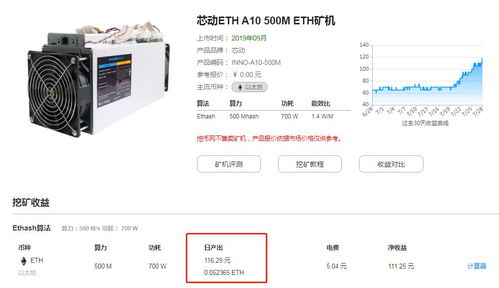

The US mining market is particularly competitive, influenced by factors such as regional energy prices, governmental regulations, and innovative technological advancements. New players often face the dilemma of balancing upfront cost against operational efficiency. High-efficiency mining rigs tend to have a better initial price tag but can quickly recoup costs through reduced electricity consumption. Conversely, older models may have higher hash rates yet deliver diminishing returns due to excessive power requirements and susceptibility to breakdowns. It’s imperative to consider not only the specs like terahashes per second (TH/s) but also the overall energy efficiency measured in joules per terahash (J/TH). Such metrics help miners future-proof their investments against rising energy fees.

Furthermore, the evolution of mining hardware continues at a breakneck pace, with companies relentlessly pushing boundaries to develop next-generation devices equipped with AI-enhanced chipsets and adaptive cooling systems. These advancements are reflected across different cryptocurrencies, whether it’s the bitcoin’s ASIC dominance or Ethereum’s shifting paradigm resulting from protocol updates like Ethereum 2.0. For miners targeting altcoins or multi-algorithm rigs, flexibility is key—allowing rapid pivoting if certain coins become unprofitable or undergo major network changes. Consequently, opting for modular mining setups or hybrid mining rigs can dramatically improve resilience and profitability in the volatile crypto environment.

Choosing high-efficiency mining machines for the US market is not simply about buying the most powerful miner; it necessitates an intricate evaluation of mining economics, technological trends, and operational logistics. Collaboration with hosting services and understanding the crypto exchange landscape further enrich these decisions. By aligning hardware choices with specific mining goals, coin preferences, and risk tolerance, miners can carve out a competitive advantage in this high-stakes, high-reward domain. Ultimately, staying informed, agile, and resourceful forms the bedrock of successful crypto mining in the United States and beyond.

Leave a Reply